Renters Insurance in and around Orange

Your renters insurance search is over, Orange

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's a house or a townhome, protection for your personal belongings is a good precaution, especially if you own items that would be difficult to fix or replace.

Your renters insurance search is over, Orange

Coverage for what's yours, in your rented home

Why Renters In Orange Choose State Farm

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented condo include a wide variety of things like your desk, couch, microwave, and more. That's why renters insurance can be such a good decision. But don't worry, State Farm agent Heather Montagne has the efficiency and experience needed to help you understand your coverage options and help you insure your precious valuables.

Don’t let worries about protecting your personal belongings make you uneasy! Call or email State Farm Agent Heather Montagne today, and explore how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Heather at (409) 886-3589 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

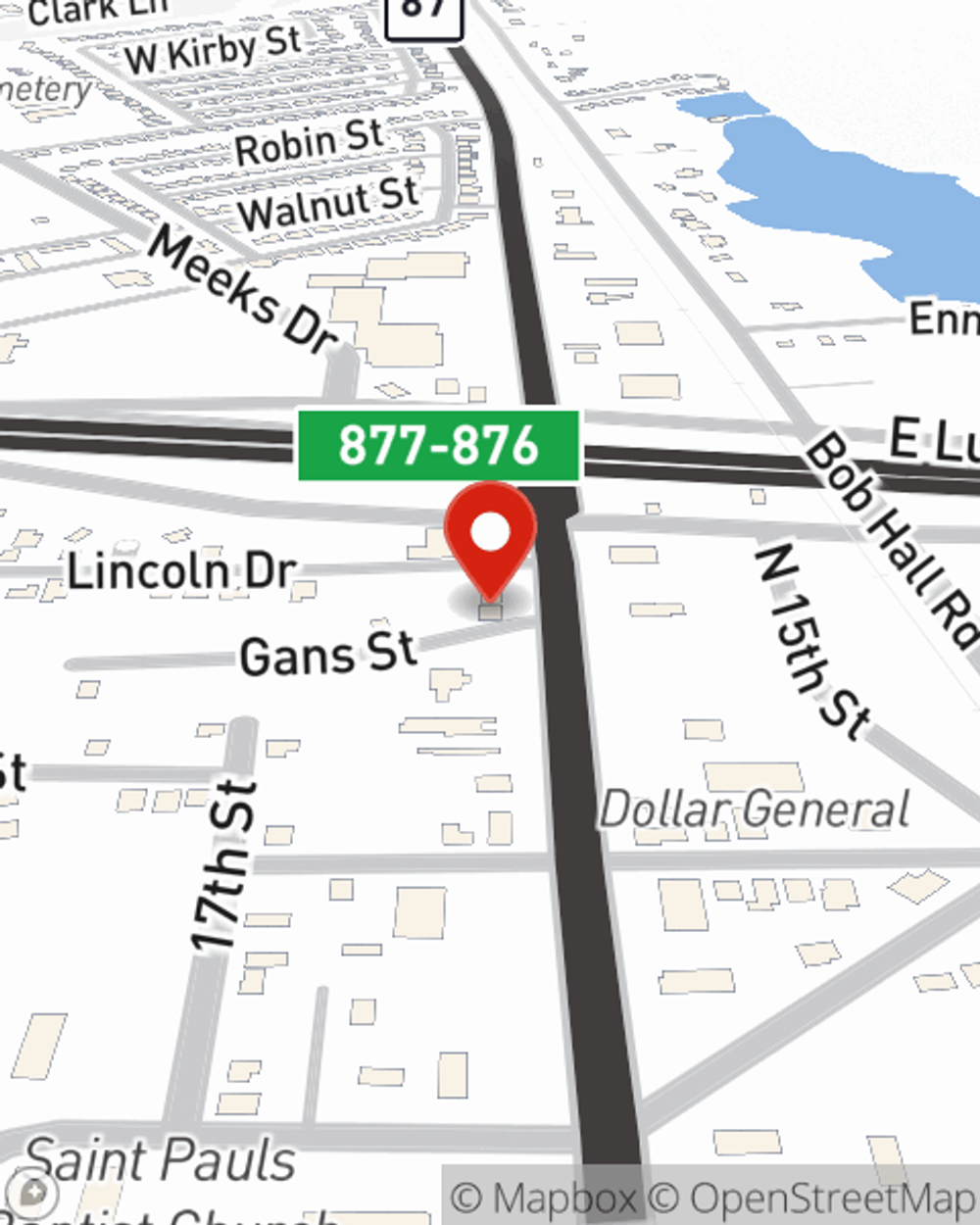

Heather Montagne

State Farm® Insurance AgentSimple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.